50 wealthiest Greek-Americans for 2017

The newspaper The National Herald issued the annual list of 50 Wealthiest Greek- Americans. Skill, knowledge, persistence, and timing. The people featured in the list enjoy all of these gifts, in greater or fewer amounts. and have reached the pinnacle in their fields and profited immensely, often bringing profit to those around them as well.

See the 50 wealthiest Greek Americans:

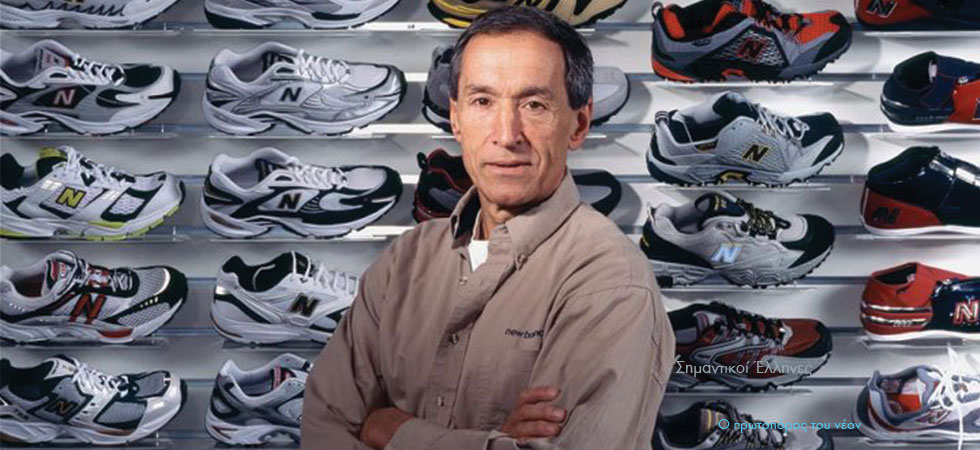

1.Jim Davis – $5.2 BILLION

James S. “Jim” Davis, the Chairman of New Balance (NB), tops the list again this year. Davis, son of Greek immigrants bought the retail sports footwear company in 1972 and took the company to new heights four years later with the development of the New Balance 320 running shoe. The company has since grown, now featuring clothing and equipment for lacrosse and soccer.

2.Haseotes Family – $4.17 BILLION

The Haseotes Family tops the list of the wealthiest Greek-American family and in 2016 they made a major company change, selling off its subsidiary Gulf Oil. The company was founded by current CEO Ari Haseotes’ grandparents, Vasilios and Aphrodite, in 1938. That year, the Haseoteses emigrated from Greece’s Macedonia and Epirus regions to the United States, purchasing a one-cow dairy farm in Cumberland, RI for $84. Cumberland Farms expanded across state lines and eventually grew to become the largest dairy farm operation in Massachusetts. In 1956, the company opened a jug-milk store in Bellingham, MA. Few convenience food stores with dawn-to-midnight service every day of the week existed in the northern part of the country in the 1950s.

3.John Catsimatidis – $3.4 BILLION

At a personal fortune estimated at $3.4 billion, John Catsimatidis remains very close to the top this year, and continues to be in the public eye, particularly as he considers another possible campaign for public office. Settling into a humble Harlem tenement as an infant with his parents from the tiny Greek island of Nisyros, Catsimatidis, 67, through decades of hard work and innovation, is a self-made billionaire. In a self-funded campaign for mayor of New York City in 2013, in which he finished a strong second in the Republican primary, Catsimatidis has hosted his own Sunday morning radio program on New York City’s AM 970 radio station, Cats Roundtable. The show is really two in one, featuring local and national news, with an array of local and nationally-known politicians and other influential guests stopping or calling in on a regular basis. Catsimatidis is chairman and CEO of the Red Apple Group, which is among the country’s largest privately held companies with 8,000 employees and estimated annual revenues of $4.3 billion.

4.Tom Gores – $3.3 BILLION

Tom Gores, 52, was born in Nazareth, Israel to a Greek father and a Lebanese mother. When he was only four, the family moved to Genessee, MI. After earning a bachelor’s degree at Michigan State University, he joined his brother Alec (also featured in this edition) in buying out companies. He founded Capital Equity in 1995, which remains one of the largest private companies in the United States. Headquartered in Los Angeles, CA, the company has offices in New York, Boston, London, and Singapore. Its in-house business development, M&A, transition, legal, real estate, marketing, finance, and operations teams enable us to resolve matters expeditiously. In 2011, Gores and Platinum became owners of the National Basketball Association’s Detroit Pistons. In August, 2016, he purchased Platinum’s stake and became sole owner. As Forbes reported when Gores first purchased the team, the billionaire is “a sports nut,” who found time amid his busy schedule to coach his daughters’ youth soccer and basketball teams.

5. John Paul DeJoria – $3.1 BILLION

John Paul DeJoria is a member of “The Giving Pledge,” a charity led by Warren Buffet and Bill and Melinda Gates. In 2016, this billionaire who finishes near the top of the list with a net worth estimated at $3.1 billion, has pledged to give more than half of it away. “The more I make, the more I get to give back. Success unshared is failure,” he told CNBC. Born to an Italian immigrant father and a Greek immigrant mother who divorced by the time he was 2, DeJoria has known poverty repeatedly: first during his childhood being raised by a single mother in Los Angeles, CA, and two periods of homelessness as an adult. Today, he is on lists of the world’s billionaires, and one of America’s richest living veterans. His John Paul Mitchell Systems hair products and Patron Spirits, both still privately held, are each worth more than a billion dollars. Paul Mitchell products are available in more than 100,000 salons in the United States and are distributed throughout the world.

6. Dean Metropoulos – $2.5 BILLION

Dean Metropoulos, is Chairman and CEO of Metropoulos & Company, a boutique buyout and management firm. He remained very high on the list, as a result of his $2.5 billion estimated worth, slightly up from last year’s $2.4. In July 2013, Metropoulos paid $410 million to buy Hostess Brands and return Twinkies to grocery shelves after the company had filed for bankruptcy protection and closed its doors. Hostess has made a remarkable turnaround and Metropoulos made news this past July by announcing the intention to take the company public. He sold Pabst Brewing for an estimated $750 million in September 2014, nearly tripling his 2010 investment. His sons, Evan, 35 and Daren, 32, are and have been an integral part of the turnaround of the acquired companies. Pabst remains one of the fastest-growing brewing companies in the United States, if not the fastest. Metropoulos is very well known in the private equity, investment banking, and financial community, having spent nearly three decades acquiring, restructuring and growing nearly 80 different businesses involving approximately $14 billion in capital in the United States, Mexico and Europe. Many of these were subsequently taken public or sold to strategic acquirers. The Greek-born Metropoulos moved to the United States with his parents at age 9. Typical of many immigrants, his parents worked hard and encouraged their children to pursue their dreams. He remains ever-grateful and humble for their sacrifices and commitment.

7.Alex Spanos – $2.4 BILLION

Best known throughout the sports world as owner of the NFL’s San Diego Chargers, Alex G. Spanos, continues to add to his net worth, finishing at $2.4 million in 2016, according to Forbes. Spanos, also founder of the real estate development company A.G. Spanos, is the son of Greek immigrants. He began his career as a baker, but in 1951 used an $800 loan to purchase a panel truck and began selling sandwiches to farm workers. He then used his profits to invest in real estate, and by 1960, he had an incorporated business. Today, his firm A.G. Spanos is one of America’s largest housing developers, and is one of the largest family-owned construction and property management companies in the nation. It has built more than 120,000 units in 19 states. Spanos handed control of the company to his sons in 2003: Dean serves as Chairman and CEO and Michael serves as President. In 2002, Spanos published his autobiography, Sharing the Wealth: My Story.

8.Jaharis Family – $2.35 BILLION

The Jaharis Family Patriarch, Michael, passed away in early 2016 at age 87. He founded Key Pharmaceuticals, Kos Pharmaceuticals, & Vatera Healthcare Partners. The son of Greek immigrants, Michael Jaharis was born in Chicago, IL. He earned a bachelor’s degree from Carroll University in Wisconsin, served in the U.S. Army Medical Corps during the Korean War, and later attended night school at DePaul University to earn a law degree while working as a sales representative for Miles Laboratories. He remained Chairman Emeritus of the Kos board until his passing.

9. Peter Nicholas – $2.3 BILLION

Peter Nicholas, co-founded the medical device company Boston Scientific with scientist John Abele in 1979, after meeting Abele at a children’s’ soccer game. Boston Scientific is a worldwide developer, manufacturer and marketer of medical devices whose products are used in a range of interventional medical specialties, including interventional radiology, interventional cardiology, peripheral interventions, neuromodulation, neurovascular intervention, electrophysiology, cardiac surgery, vascular surgery, endoscopy, oncology, urology and gynecology. In 2016, Nicholas announced that he would step down as Boston Scientific’s chairman, a year ahead of his intended retirement.

10.George Marcus -$2.2 BILLION

Born George Moutsanas in Euboea, Greece, George Marcus, together with his partner, William A. Millichap, is founder and chairman of Marcus & Millichap Company (MMC), one of the country’s premier providers of investment real estate brokerage services, and the parent company of a diversified group of real estate, service, investment and development firms. MMC’s featured company, Marcus & Millichap Real Estate Investment Services, has established itself as a leading real estate firm with more than 1,200 brokers in markets throughout the United States. In 2015, due to the company’s success, Marcus’ net worth catapulted him from millionaire to billionaire. The two partners launched a new business model nearly four decades years ago, based on matching each property with the largest pool of pre-qualified investors. Marcus came to San Francisco from Greece at age four. He completed his undergraduate studies in Economics at San Francisco State University in just two and a half years, and founded the university’s first economics club. In 2008, Marcus co-founded the National Hellenic Society.

11. Peter Angelos – $2.1 BILLION

Peter G. Angelos, is an attorney and is best known for being owner, chairman and CEO of Major League Baseball’s Baltimore Orioles. He bought the Orioles in August 1993, leading a group of investors including prominent Marylanders, including novelist Tom Clancy, in purchasing the team for $173 million, a record price at the time. The Orioles enjoyed some success early under Angelos’ ownership, making the postseason as a wild card team in 1996 and winning the American League East Division title in 1997. The Orioles’ worth has jumped 60% in two years, to close to $1 billion. Angelos was born in Pittsburgh, PA on July 4, 1929, to immigrants from the island of Karpathos. He went to Baltimore at age 11, where his family settled in the Highlandtown section. He graduated from Eastern College and the University of Baltimore School of Law, where he was class valedictorian, and went onto a lucrative career in trial law, specializing in cases involving harmful products, professional malpractice, and personal injury. A lifelong Democrat, he won election to the Baltimore City Council and served on the Council from 1959 to 1963. He ran for mayor as an independent in 1964, but lost. He has been an active supporter of national Democratic candidates.

12. George Argyros – $2.1 BILLION

George L. Argyros is well known in a wide variety of prominent circles, as his long and illustrious life has included achievements ranging from real estate, to sports, to international diplomacy. Argyros served as US Ambassador to Spain and owner of the professional baseball team Seattle Mariners. But Argyros, made his fortune in grocery stores and real estate. A second-generation American of Greek descent, he was born in Detroit, MI and raised in Pasadena, CA. Today, his privately held Arnel & Affiliates owns and manages 5,500 apartments and 2 million square feet of commercial space. In 2001, then-President George W. Bush appointed Argyros U.S. ambassador to Spain. Argyros sold the Mariners in 1989, after trying to move them elsewhere, and had also pursued purchase of the San Diego Padres.

13.Alec Gores – $2.1 BILLION

Alec Gores, 63, like his brother Tom (also featured in this edition) was born to a Greek father and Lebanese mother, in Nazareth, Israel. The family moved to Genesee, MI when he was a teenager. “My father was willing to give up literally everything he had [in Israel] and pack his bags and bring us here,” Gores told Forbes in October, 2016. “He did it for the kids, to make sure we have a better future.” Today, Gores heads the Beverly Hills-based private equity firm The Gores Group, which has $2.5 billion in assets. In July, he joined C. Dean Metropulos, also featured in this edition, to take the food snack giant Hostess public. Gores famously lost over $17 million in a three-day backgammon series to fellow billionaire JP McManus in 2012, the Independent reported, and Gores promptly “paid up like a gent.”

14.Peter Peterson – $2 BILLION

Peter G. Peterson has gone down in rankings on this list over the years, much to his credit – because he has given away a good amount of his money to philanthropic causes – though he climbed back up a bit, to $2 billion, in 2016. Having served as U.S. Secretary of Commerce under President Nixon, Peterson made his fortune as the co-Founder and former chairman of the Blackstone Group, one of the world’s largest investment firms with 25 offices around the world. Peterson co-founded Blackstone with Stephen Schwarzman in 1985. Peterson retired from the company in late 2008, selling most of his shares and receiving $1.85 billion in cash upon exiting, before taxes and meeting several trust and charitable obligations. Peterson released his newest book Steering Clear: How to Avoid a Debt Crisis and Secure Our Economic Future (Portfolio/Random House) in 2015, in which he contends that we must address our long-term fiscal challenges in order to secure a growing and prosperous economy. The son of Greek immigrants, Peterson grew up in Nebraska. Peterson devotes a great deal of his time to his foundation and other charitable activities. Established in 2008, the Peter G. Peterson Foundation is a nonpartisan organization dedicated to increasing public awareness of the nature and urgency of key fiscal challenges threatening America’s long-term future, and to accelerating action on them.

15. James Chanos – $1.5 BILLION

James S. Chanos is informally known as “Wall Street’s most notable bear.” Founder and President of Kynikos Associates, Chanos heads the world’s biggest short-selling hedge fund. He is renowned for predicting – and profiting from – the 2001 Enron Corporation scandal. His speculations catapulted him into billionaire status last year, where he has remained. Chanos is a second generation Greek-American who grew up in Milwaukee, WI. His father owned a chain of dry cleaner store in Milwaukee and his mother worked as an office manager at a steel company. He founded Kynikos Associates (in Greek, “kynikos” means cynic) in 1985 after a Wall Street career as a financial analyst with Paine Webber, Gilford Securities and Deutsche Bank. Jim Levitas, his former boss, partnered with Chanos to launch Kynikos Associates with $16 million. A year later, Levitas, unable to endure the stress of short selling, left the company. Kynikos has offices in New York and London.

16.Logothetis Family – $1.5 BILLION

George M. Logothetis is the founding chairman and CEO of Libra Group. The conglomerate consists of 30 subsidiaries with companies operating across 35 countries. He founded the privately owned group with his brother Constantine in 2003. Today George Logothetis is based in New York, while Constantine, who is Executive Vice Chairman of the group, is based in London. The diversified group was built on the decades of work of their father, shipowner Michalis G. Logothetis, who is on the Libra Group’s board and is a senior advisor. A series of strategic steps by the younger generation allowed them to extend into new areas at a time when many shipping companies were strained. Despite the financial crisis, the Libra group companies have acquired $7 billion of assets over the past several years.

17. Roy Vagelos – $1.39 BILLION

Dr. Pindaros Roy Vagelos earned a medical degree over half a century ago. Since then, he has had a long and distinguished career in healthcare, and particularly in pharmaceuticals. He served as Chairman and CEO of pharmaceutical giant Merck & Co. from 1985 to 1994. He joined the worldwide health products firm in 1975 as senior vice president of research, and became president of its research division in 1976. Starting in 1982, he served as senior vice president of strategic planning. He continued to hold both positions until 1984, when he was elected executive vice president. Before assuming broader responsibilities of business leadership, Vagelos had won scientific recognition as an authority on lipids and enzymes, and as a research leader. Vagelos, whose parents were born in Asia Minor and emigrated to the US in the 1920s, earned his bachelor’s degree with honors in 1950 from the University of Pennsylvania.

18.Demoulas Family – $1.25 BILLION

The Demoulas family, one of America’s richest families, is difficult to gauge, both in terms of net worth and current status of control of their lucrative Market Basket Supermarket chain. Nonetheless, the family’s history and contributions is notable. Their supermarket empire began in 1917, when Greek immigrants Athanasios (Arthur) and Efrosine Demoulas opened a small market selling fresh lamb in Lowell, MA. In 1950, the original store model was revamped and premiered as the DeMoulas Superette. Arthur turned the business over to his two sons, George and Telemachus (Mike) in 1954. The following year, the Superette was tripled in size and became DeMoulas Super Market. Over the next 17 years, the two brothers converted the lamb shop into a successful grocery store chain of 15 stores. The brothers each signed a will naming the other as executor of his estate, and reportedly agreed to divide the business equally between their two families in the event of one of their deaths. Both brothers had four children, and both named a son Arthur, after their father. From their youth, both cousins (George’s son Arthur S. Demoulas and Mike’s son Arthur T. Demoulas) followed their fathers in the family business. In 1971, George, then 51, died unexpectedly while vacationing in Greece with his family. Mike continued to expand the chain and began opening stores under different names, including Market Basket. Tensions began brewing between the two families and erupted in the 1990s, when it came to light that Mike had been secretly shifting his brother’s half of the company assets into his own name after George’s death. Two decades of lawsuits followed, Mike and his family on one side and George’s heirs on the other. The feud was settled in December 2014, when Arthur T., who ran the business after his father’s death in 2003, finalized a buyout of Arthur S., and the rest of George’s heirs for $1.6 billion, according to Forbes. Despite those difficulties, the business has flourished. Over the past decade it added approximately 30 new stores and a new perishable/produce distribution center, and doubled sales. Today, the Tewskbury-based DeMoulas Market Basket, Inc. owns 75 stores in Massachusetts, New Hampshire, and Maine, employs 27,000 people and earns more than $4 billion in annual sales.

19.Kostas & Tom Kartsotis – $1.02 BILLION

Kosta Kartsotis, 63, and Tom Kartsotis, 56, are founders of the Fossil Group, Inc., whose brand is widely associated with watches, jewelry, and other accessories, as well as clothing. Kosta serves as chairman and CEO; Tom still owns a small stake, but in 2003 founded Bedrock Manufacturing, a Texas-based private equity and brand management firm. Based in Richardson, Texas, Fossil is valued at $4.35 billion and is on Forbes’ Global 2000, a list of the world’s biggest public companies. With 400 retail locations and more than 14,000 employees, the company sells its products in 120 countries around the world. Founded in 1984, Fossil is a designer and manufacturer of the aforementioned merchandise, and also sunglasses and wallets. Its brands include Fossil, Relic, Abacus, Michele Watch and Zodiac. The company designs, manufactures and distributes with Burberry, DKNY, Emporio Armani, Columbia Sportswear, Diesel, Michael Kors, Marc Jacobs and Adidas.

20. Ted Leonsis – $1 BILLION

Ted J. Leonsis is the founder, chairman, CEO and majority owner of Monumental Sports and Entertainment, which owns and operates the professional sports teams Washington Capitals (National Hockey League), Washington Wizards (National Basketball League), Washington Mystics (Women’s National Basketball League) and Verizon Center in downtown Washington, DC. The partnership also operates Kettler Capitals Iceplex (the Washington Capitals’ training facility and front office headquarters) and the George Mason University Patriot Center. He formed Monumental Sports in June 2010 by merging his Lincoln Holdings LLC and Washington Sports & Entertainment Limited Partnership. After surviving an airplane crash landing in 1983, he resolved to “rethink my priorities and how I planned to lead my life going forward,” he explained. He drafted a list of 101 goals to accomplish. To date he has completed 82 of the tasks, including owning a sports franchise, playing one-on-one basketball with Michael Jordan, and starting a family charity foundation. In 2010, he published The Business of Happiness: 6 Secrets to Extraordinary Success in Life and Work. A pioneer of the Internet and new media, Leonsis participated in launches of the Apple MacIntosh, the IBM PC and the Wang office automation. He has led four businesses that have grown at record rates: he built Wang WP (the first word processor) from a $200 million to a $1 billion company with the largest female management team in the country. He built AOL into the first $1 billion interactive services company and the world’s biggest media company, helping to increase its membership from fewer than 800,000 to more than 8 million in a four-year span (1994-97). He retired from AOL in 2006 and currently serves as vice chairman emeritus. The grandson of Greek immigrants, Leonsis was born to a family of modest means in Brooklyn, and spent his early years there.

21.George Sakellaris – $963 MILLION

George Sakellaris is Chairman of the Board, President, and CEO of Ameresco, which is one of the largest energy solutions companies in North America. The Framingham, MA company specializes in providing comprehensive services, energy efficiency, infrastructure upgrades, asset sustainability, renewable energy, and energy information management solutions. Born in Laconia, Greece, Sakellaris founded Ameresco in 2000 and took it public 10 years later. Today it has dozens of offices throughout North America and Europe and over a thousand employees providing strong local operations. “Green. Clean. Sustainable” is the motto of the company that increases energy efficiency for federal, state and local governments, healthcare and educational institutions, housing authorities, and commercial and industrial customers. After graduating from high school in Greece, Sakellaris arrived in Bangor, ME, as a college exchange student in 1965 to go to college. He spoke little English when he first enrolled at the University of Maine-Orono, but worked his way through college and earned a BSEE degree, driven by a love of mathematics and the sciences. His parents arrived in the US in 1969 and the family settled in Boston.

22.George Behrakis – $930 MILLION

George D. Behrakis, Founder and Chairman of Mythos, LLC, a private investment company based in Lexington, MA, also serves on the board of the Lexington-based venture capital firm Gainesborough Investments, and is a renowned philanthropist. Of all his philanthropic endeavors, the most dear to Behrakis is the anti-smoking campaign in Greece he helped to fund. Behrakis gave a $1.8 million grant in 2010 to a Harvard University School of Public Health study on smoking in Greece. Since then he has donated more funds to publish a self-help guide to quitting, produce school programs, and further study at the academy of Athens on the effects of smoking. A 1957 graduate of Northeastern University in Boston, Behrakis also studied at Boston University, and is a recognized leader in the pharmaceutical industry. He became best known, perhaps, for his talent in solubilizing previously insoluble chemicals and making them stable for medical use. The son of Greek immigrants, Behrakis was born and raised in Lowell, MA. His wife, Margo, and he have established chairs and scholarships at various universities and medical centers. In 2003 Northeastern University and Medical Center in Boston opened the Behrakis Health Science Building and also created the Center for Drug Discovery. In December 2015, Behrakis was given an honorary doctorate from the Medical Faculty of the National and Kapodistrian University of Athens for his contributions to science, pharmaceuticals, and medicine, and for his extensive humanitarian endeavors. Extremely moved by the experience, he told TNH in February, 2016 that “you can receive a lot of honors, but when you receive an honor from your own, your family, being first-generation Greek, to receive an honor from Greece is one of the high points of my life.”

23. John Calamos – $770 MILLION

John P. Calamos is founder and chairman of Calamos Investments, a global asset management firm. In 2016, he stepped down as CEO. The company traces its roots to the 1970s when Calamos used convertible securities, which were little known at the time, to help his clients grow and preserve their wealth. He took his company public in 2004 under the NASDAQ ticker CLMS. The factors to which Calamos attributes his success include his Greek heritage, a strong work ethic and entrepreneurial spirit. The son of Greek immigrants, he grew up above his family’s grocery store on Chicago’s west side and attended Chicago public schools. He developed his passion for the stock market as a teenager and began his investment career when his parents entrusted him with the family’s $5,000 nest egg. Calamos also credits his military service as a key factor in his success, as it solidified his view of the importance of discipline, risk assessment and teamwork. He served five years in active duty in the US Air Force, flying the B-52 bomber and in Vietnam as a forward air controller.

24.John Payiavlas – $706 MILLION

John Payiavlas, 85, is chairman of AVI Foodsystems, the country’s largest independent, family-owned and operated contract food service company, providing vending, institutional dining and coffee service operations. A son of Greek immigrants, Payiavlas traces his company’s beginning to purchasing a few vending machines for the family’s Village Café in his hometown of Warren, OH. He founded AVI in 1960, and the company currently serves millions of consumers daily in some of the most prestigious institutions in America, including industrial centers, corporate headquarters complexes, universities, school systems and healthcare facilities throughout country. Their clients include Ohio State University, FedEx, DirecTV, BMV of North America, Xerox, General Electric, Wellesley College, Progressive Insurance, University of Pittsburgh Medical Center, Verizon, and Xerox. Intensely private, Payiavlas runs the company as chairman of the board, while his son Anthony is president and CEO and his daughter Patrice (Patsy) Kouvas serves as vice chairman.

25. Jamie Dimon – $700 MILLION

Jamie Dimon is chairman and CEO of America’s largest bank JPMorgan Chase, and considered one of the nation’s most powerful people. Listed at a $1.1 billion net worth in 2015, Forbes knocked him out of the “billionaire’s club” early in 2016, estimating his net worth had fallen to just under $900 million due to a portfolio wane, and listed him at $700 million later in the year. But that number very well could be back up into the billion range, as the New York Post reported late in 2016 that since Election Day, Dimon has been one of the biggest beneficiaries of the Wall Street boom. He has been on Time magazine’s list of 100 most influential people three times since 2006. In July 2014, Dimon said he had been diagnosed with throat cancer. The following December, he announced to his staff that he had concluded treatment and that after testing, his doctors found no evidence of cancer in his body, although he will continue to be monitored. Although he continued to work during his treatment, he had cut back on his schedule. By 2016, it appeared the cancer was in remission and he had a good long-term prognosis. Dimon was born in New York City. His grandfather, a Greek immigrant from Smyrna, was a broker and passed his knowledge of the business onto his son and partner Theodore, Dimon’s father. Forbes reported in November that Dimon told Donald Trump’s presidential transition team that he did not want to be considered for Secretary of the Treasury, though it is unclear if that was because if he accepted the position he would have to divest his JPMorgan Chase holdings.

26. John Pappajohn – $647 MILLION

John Pappajohn is an entrepreneur, a philanthropist, and at 88 years old, still a self-proclaimed workaholic. President of Equity Dynamics and Pappajohn Capital Resources, he is also sole proprietor. Equity Dynamics is a financial consulting entity; Pappajohn Capital Resources is a venture capital firm. Both are located in Des Moines, IA. Pappajohn serves as director on the boards of three publicly traded companies: Cancer Genetics, Inc., American CareSource Inc., and CNS Response, Inc., a company which uses EEG-generated biomarkers for use in personalized medicine in psychiatry. Pappajohn has served as director in over 40 public companies. Pappajohn emigrated from Euboea, Greece to the United States when he was just nine months old. His father died when he was 16 years of age, and Pappajohn worked to pay his way through college. He graduated from the University of Iowa’s College of Business Administration in 1952. Throughout his career as a venture capitalist, he has been an early investor in more than 100 companies, most of which are dedicated to healthcare and biotechnology industries. Both Pappajohn and his wife, Mary, are avid philanthropists, having partnered in numerous endeavors, providing millions for scholarships, business opportunities and community enhancements. His charitable donations include the John & Mary Pappajohn Clinical Cancer Center, and Pappajohn Entrepreneurial Centers at five Iowa universities and colleges. To date, over 150,000 college students have taken part in the latter, which have sparked over 1,000 new businesses. The Pappajohn Scholarship Foundation has distributed over $4 million in grants to support ethnic, disadvantaged, and/or minority students over the past 10 years.

27.Angelo Tsakopoulos – $600 MILLION

In 2016, Angelo Tsakopoulos achieved two milestones. He turned 80 years old, and he was honored as a permanent part of the United States Congressional Record. Born in Greece, Mr. Tsakopoulos came to America at 15, sailing into New York City under the inspiring gaze of the Statue of Liberty. He moved to Chicago to live with family, before eventually continuing west to the San Joaquin Valley in California. Encouraged by a close mentor to continue his education, Mr. Tsakopoulos studied political science and business at California State University, Sacramento. While attending school, Mr. Tsakopoulos supported himself as a real estate salesman, foreshadowing his highly successful career in real estate development. Mr. Tsakopoulos founded AKT Development Corporation in Sacramento, CA, which became a leading real estate developer in the area under his leadership and has built tens of thousands of homes and more than 30 million square feet of office space. Mr. Tsakopoulos and his family have also been dedicated supporters of civic and community causes. His daughter, Eleni Tsakopoulos Kounalakis, was appointed U.S. Ambassador to Hungary in 2010. Tsakopoulos and his family have established Hellenic Studies chairs at several major American universities across the country, Georgetown, Stanford and Columbia among them.

28. George Hatsopoulos – $481 MILLION

George N. Hatsopoulos, was awarded at the November 2009 Boston History & Innovation Awards for “half a century of innovations in environmental quality, health and safety technologies.” The Greek-born scientist wanted to change the way the world makes electricity. He and his brother John founded Thermo Electron in 1956 (with a $50,000 loan from a Greek shipowner). Thermo Electron grew into an international company recognized as a global leader in environmental monitoring and analysis instruments, and a major producer of paper-recycling equipment, biomedical products, alternative-energy systems and other products and services related to environmental quality, health and safety. In 1981, it was ranked 739th among Fortune’s 1,000 largest industrial firms. In 2000, Hatsopoulos, his brother John, and other private investors purchased Tecogen, formerly the research and development division of Thermo Electron. His training began in Greece at the National Polytechnic Institute in Athens. In 1996, Hatsopoulos won the John Fritz Medal, the highest American award in the engineering profession. In 2007, he was one of the nine prominent Greek-Americans who were selected by President Carolos Papoulias to be honored with the Hellenic Republic’s prestigious Commander of the Order of Honor award. Until his retirement in April 2012, Hatsopoulos was the chairman of American DG Energy Inc., the leading on-site utility he formed with his brother in 2001 offering electricity, heat, hot water and cooling to commercial, institutional and industrial customers. The professorship at MIT in his name perpetuates his life’s work, as holders of that seat develop new breakthroughs in long-distance Wi-Fi.

29.John Rangos – $455 MILLION

John G. Rangos made his fortune through the transportation, disposal and management of industrial wastes, as well as security services. Born in Steubenville, OH, Rangos grew up during the Depression in Northern West Virginia and Fredericksburg, VA. His education at the Houston School of Business was interrupted when he joined the Active Force Reserve unit in Pittsburgh, PA. He served with great distinction in the Army from 1951-54, including a stint on a combat signal team in the Far East. He founded Chambers Development Inc. in 1971, a firm that provided waste treatment services, developed commercial recycling programs, and broke ground with specially lined, layered landfills to protect groundwater supplies. He is founder and director of the John G. Rangos Sr. Family Charitable Foundation, founder and former president of the Congressional Medal of Honor Foundation, and founder and chairman emeritus of International Orthodox Christian Charities.

30.Peter Barris – $444 MILLION

Peter J. Barris is a venture capitalist known for helping to launch companies including Groupon, CareerBuilder and Diapers.com. Forbes has included him on its “Midas List” of the world’s best venture capitalists and technology investors every year since 2007. He has been managing general partner of leading venture capital investor New Enterprise Associates, Inc. (NEA) since 1999, having joined the company in 1992. Barris grew up in Chicago, IL. His father, James, was an engineer, and his grandparents were from Greece. He earned an MBA from Dartmouth College in 1977, after studying electrical engineering at Northwestern.

31. George Yancopoulos – $428 MILLION

George Yancopoulos joined Regeneron Laboratories in 1989 as its Founding Scientist and is currently President and Chief Scientific Officer. Dr. Yancopoulos earned MD and PhD degrees from Columbia University, and was the eleventhmost cited scientist in the world in the 1990s. He selected in 2004 as a member of the National Academy of Sciences. Encouraged by his father, a first-generation Greek immigrant who complained how little the university life paid, Yancopoulos in 1988 jumped ship to a small Tarrytown, NY Biotech firm called Regeneron and helped its worth rocket 2,240 percent in the past five years. His career, featured in Forbes, showed how his scientific ability and humility combined to help him develop drugs for patients with illnesses from asthma to cancer and made the company a force to be reckoned with in its field. He’s also working on a big project to sequence patients’ DNA and Deutsche Bank estimates that his experimental drug for allergic conditions could generate $10 billion in annual sales by 2025.

32.John Georges – $370 MILLION

John Georges is an entrepreneur in multiple industries, an avowed philanthropist, and a strong supporter of Hellenic causes. He is Founder and CEO of Georges Enterprises, a company based in Elmwood, LA, specializing in acquiring and growing businesses. It invests in food vending, grocery distribution, video/arcade entertainment, restaurants, and media outlets. Georges Enterprises began as Imperial Trading in 1916, a wholesale grocery distribution company founded by Georges’ grandfather Gus Pelias. The company is now the eighth largest convenience store supplier in the nation. Georges started out in the family business at a young age, sweeping warehouse floors at age 11 and making deliveries by age 15. His father, Dennis Georges, immigrated to the US after serving in the Greek Resistance and the Royal Greek Air Force at a young age during World War II.

33.Nicholas Galakatos – $368 MILLION

Nicholas Galakatos has been Managing Director of Clarus Ventures since company’s beginnings in 2005. The Cambridge, MA-based company is a life sciences venture capital firm founded by a team of “accomplished investment professionals with extensive and complementary industry backgrounds which have enabled them to establish a long history of success in creating value,” according to its website, which also reports $1.2 billion of assets under its management “across two life sciences-dedicated funds.” The Greek-born Galakatos has over two decades of healthcare sector industry and investment experience. Galakatos was born in Athens and raised in Thessaloniki. He earned a doctorate in organic chemistry at MIT before his post-doctoral studies at Harvard Medical School.

34.Nicholas Karabots – $326 MILLION

Nicholas G. Karabots is the owner of Kappa Publishing Group, Inc. the nation’s largest publisher of puzzle magazines and books, as well as companies related to real estate and winemaking. His parents, Konstantina Hrisomalis and Georgios Karabotsios, hailed from the Peloponnesian villages of Anavriti and Malendreni, respectively. The family name was shortened when his father arrived on Ellis Island. Karabots was born in New Jersey and raised in the South Bronx, and attended the Greek American Institute. After his father lost his restaurant business in the Wall Street crash of 1929, Karabots held his first job at age 9, in 1942, as a shoeshine boy in Manhattan’s Union Square. After graduating high school in 1951, he entered the printing industry, learning the ropes at an RCA affiliate on Wall Street before becoming a manager of printing operations elsewhere. Eventually he achieved sales and then management positions, offered by a Hellenophile from Austria, who was the owner of Polychrome, a manufacturer of supplies related to the printing industry. In 1964, he launched, with a partner, Phota Inc., a company that manufactured photographic chemicals specific to the development of X-Ray film and assisted in the development and importation to the United States of Fuji film. In 1970 he acquired a printing company in Scranton, Penn. and expanded it via the printing and binding of TV Guide among other nationally known magazines. That company, today known as Kappa Graphics, LP. Today he is Chairman of the Board and CEO of The Spartan Organization, a company he founded that provides management and legal services to the various Karabots affiliates.

35.Michael Capellas – $325 MILLION

Michael D. Capellas is a 30-plus year veteran of the information technology industry, founded Atlanta-based Capellas Strategic Partners, a strategic technology advisory firm, in 2012. From 2007 to 2010, he was the Chairman and CEO of First Data Corporation (FDC), the world’s leading payment processing company. He was on the board of directors of VCE, the Virtual Computing Environment Company, from January 2006 to November 2012, serving one year as chairman and CEO. The company was formed by tech giant Cisco and EMC Corporation with investments from VMware and Intel, offering technology products and solutions for cloud-based computing. He serves on the board of Cisco, a multinational corporation networking and communications technology and services company. Capellas says he inherited his gritty determination from his father, a Greek citizen who fought with the Greek Army against the Germans in Italy during World War II. After the war, the elder Capellas met and married his wife, Juliet, in Italy. The family then immigrated to Ohio, where Capellas’ father worked his way up from laborer to superintendent at the Republic Steel Corporation. In early 2017, JDA Software named Capellas Chairman after Bal Dail stepped down from that position.

36.Michael Kalogris – $321 MILLION

Michael Kalogris cofounded Arete Capital Partners, a private investment company, in 2008. Arete, where he is Managing Partner, functions as an operating partner of the New York based equity firm Catalyst Investors. Kalogris was chairman and CEO of SunCom Wireless, a wireless carrier which had operated in the southeastern United States since 1999, and in parts of the Caribbean since 2004. Kalogris has consistently distinguished himself as a leader in the highly competitive wireless industry, and is a former board member as well as former chairman of the Cellular Telecommunications & Internet Association (CTIA).

37. Sotirios Vahaviolos – $280 MILLION

Sotirios J. Vahaviolos is Founder, Chairman, and CEO of Mistras Group, a global provider of technology-enabled asset protection solutions used to evaluate the structural integrity, safety and efficiency of critical, industrial and public infrastructure. The NJ-based Mistras’ newest and largest nondestructive evaluation laboratory in Houston, TX. With more than 100 offices and 5,800 employees in 16 countries, Mistras Group provides the majority of their services to clients on a regular, recurring outsourced basis. It monitors daily such historic bridges as the Ben Franklin bridge in Philadelphia, PA, the Severn bridge connecting England and Wales, the Bay Bridge in San Francisco, SC, platforms and oil rigs in places such as the North Sea, US-based nuclear power plants, and other industrial plant facilities in countries all over the world, through the help of online monitoring technologies based on satellites and other links. International clients are in the fields of oil and gas, fossil and nuclear power, public infrastructure, chemicals, aerospace and defense, transportation, primary metals and metalworking, pharmaceuticals and food processing. Among them are American Electric Power Inc., Bayer AG, BP, Bechtel Corp., General Electric Co., Boeing Co., Excelon, ExxonMobil, Shell, and Valero Energy Co. Vahaviolos, who was born in the Peloponnese, as a child ripped apart electrical machinery and rebuilt it for fun – as well as for better safety in the newly electrified village. He came to the United States to study engineering at Fairleigh Dickinson University in New Jersey, where he graduated first in his science and engineering class and went on, as a recipient of The Bell Laboratories Graduate Study Scholarship Program, to earn MS and PhD degrees in electrical engineering from Columbia University.

38.James Bidzos – $267 MILLION

James Bidzos is Founder, Chairman of the Board, President, and CEO, of Verisign, Inc., which provides domain name registry services and Internet security worldwide, Bidzos’ company offers a range of security services, including managed DNS, Distributed Denial of Service (DDoS) mitigation and cyber-threat reporting. Bidzos served as its first CEO from 1995 to 2001. In 2010 the company’s authentication services were purchased by Symantec for $1.28 billion. Bidzos returned to the CEO job in 2011. The following year, he was named Fortune’s 2012 Businessperson of the year for reviving Verisign’s income, growth, and stock performance, which previously had flagged. His compensation increased by 46 percent in 2013 to $8.5 million, including his bonus and stock awards. Born in Greece, Bidzos he came to the United States as a boy. His father worked as a barber, and his mother managed a restaurant. A former computer programmer, he is credited with foreseeing the need for online security in the early 1990s. Bidzos is an Internet and security industry pioneer, whose accomplishments include building RSA Security, an Internet identity and access management solution provider, into the early standard-bearer for authentication and encryption, and launching Verisign as a spin-off in 1995 to develop the digital certificate infrastructure for Internet commerce. Verisign operates infrastructure services that enable and protect billions of interactions every day across the world’s voice, video and data networks. He has been named one of Time magazine’s “Digital 50,” and is in CRN’s “Computer Industry Hall of Fame.” In September 2013, the Federal Aviation Administration named Bidzos, who is a certified pilot, to the FAA Airmen Certification Database.

39.Stratton Sclavos – $252 MILLION

The son of second-generation Greek-American parents, Stratton Sclavos, 55, is a partner at Radar Partners LLC, a private equity and venture capital firm based in Palo Alto, CA He served on the board of directors of Intuit, Inc. from 2001 to 2010, as well as the company Juniper Networks. In June 2014, he joined the board of digital security start-up BitGo. The company produces a digital wallet designed to tackle theft of bitcoin, a form of digital currency invented in 2009. He was chairman, president, & chief executive officer of Verisign for 12 years before he resigned in May 2007, leading that company through many acquisitions. He joined Verisign in July 1995 as one of its first employees. He helped establish Verisign as a global corporation used by millions of consumers and businesses daily as they interact on the world’s voice and data networks. Sclavos led the company through a decade of robust growth and technological innovation. His last years with Verisign were taken up with investigations into the company’s stock option program, but it is not believed that Sclavos personally benefited from the option grants in question, though it did occur under his watch. His investments include co-owning upscale Greek restaurant Dio Deka.

40.Michael Psaros – $230 MILLION

Michael Psaros is a cofounder and managing partner of private equity fund KPS Capital Partners, LP, and a member of its investment committee. KPS Capital Partners, LP us is one of the world’s leading private equity franchises, with approximately $5.2 billion of assets under management. KPS acquires non-core, underperforming or distress underperforming manufacturing and industrial companies and makes the business better by implementing operations-driven turnaround strategies. The son of George and Mary Ann Psaros and grandson of four Greek immigrants, Psaros grew up in Weirton, WV, where the lifeblood of the town was the steel industry, specifically National Steel.

41. William Stavropoulos – $219 MILLION

After a long and distinguished career at the Dow Chemical Company, where among other capacities he served as Chairman and CEO, William S. Stavropoulos, 77, moved into a different direction: he is president and founder of minor league baseball team the Great Lakes Loons. In 2005, he was inducted into the Midland County Sports Hall of Fame as a Professional Baseball Visionary for work, which includes founding the Michigan Baseball Foundation. Dr. Stavropoulos was a director at Tyco International Limited from 2007 to 2012. A major diversified, multinational company, Tyco is a leading provider of security products and services, fire protection and detection products and services, valves and controls, and other industrial products. Prior to joining Tyco, Stavropoulos spent 39 years at Dow. In addition to leading the company, he held various positions in research, marketing, and general management.

42. Chris & Harris Pappas -$214 MILLION

Brothers Christopher J. and Harris Pappas – 69 and 72 years of age, respectively, and still very much involved in their thriving family business – opened the first Pappas Restaurant in 1976. Today the privately owned Pappas Restaurants, Inc. operates 85 restaurants in eight states, is one of the best-loved restaurant chains in Texas. Six of Chris’ and Harris’ children have taken on more prominent roles in the business, including marketing, real estate, culinary research and development, and construction. Pappas Restaurants grew from the work of their father, Jim, and his brothers at Pappas Refrigeration, which they opened in 1945. Currently Pappas Restaurants has 12 brands, including Pappas Seafood Houses, Pappasito’s Cantinas, Pappadeaux Seafood Kitchens, Pappas Bar-B-Q’s, Pappas Bros. Steakhouses, Pappas Burger, Yia Yia Mary’s Pappas Greek Kitchen and the Dot Coffee Shop. Each company has its own specialty, with Yia Yia Mary’s, for instance, specializing in Greek food, fish and mezedes (Greek, with a hint of Texas). Pappas Restaurants also has a food catering business. The brothers’ grandfather, H.D., arrived in the U.S. in 1897 and became a restaurateur. His four sons followed his lead with endeavors including opening Pappas Bar-B-Q.

43.Jennifer Aniston – $200 MILLION

The iconic face of millennial sitcoms and one of the best-known personalities in Hollywood, Jennifer Aniston, lived in Crete and Athens during part of her childhood as Jennifer Anastassakis. The daughter of daytime soap opera star John Aniston (Days of Our Lives), she eclipsed her father’s television fame and success with her own role as Rachel Green on the eternally popular situation comedy, Friends (1994-2004). Born in Sherman Oaks, CA, Aniston’s family relocated to New York after their stay in Greece. Her parents divorced when she was 9, and she was raised by her mother, Nancy Dow. Besides her lucrative acting career, Aniston is in demand as a spokeswoman for brands such as Aveeno and Vitamin Water.

44.Pete Sampras – $150 MILLION

Widely regarded as one of tennis’ all-time greats, Pete Sampras, retired in 2003 with a then-record 14 grand slam titles (a record subsequently broken by Roger Federer, with 18, and tied by Rafael Nadal). Sampras, nonetheless, remains the only man to be ranked number one in the world by the Association of Tennis Professionals (ATP) six consecutive years, and is best remembered for his epic battles with fellow American Andre Agassi. Born in Potomac, MD to an American-born father of Greek descent and a mother born in Sparta, Sampras from age three showed an unusually gifted athletic ability.

45.John Varvatos – $120 MILLION

John Varvatos was born in Detroit, but his roots are from the Greek island of Kefalonia. Varvatos entered the design industry at 17, in 1983, joining Polo Ralph Lauren, and in 1990 moved over to Calvin Klein (CK), where he was in charge of menswear design and pioneered the concept of “boxer briefs,” which are men’s underpants that are a hybrid between boxers and briefs. That innovation propelled Varvatos to the top-tier of the design industry, as boxer briefs were highly touted as one of the greatest apparel revolutions of the 20th century.

46.Constantine Iordanou – $117 MILLION

Constantine “Dinos” Iordanou is president, CEO and Chairman of the Board of Arch Capital Group, Ltd, a Bermuda-based insurance/reinsurance global entity. Born in Cyprus, Iordanou arrived in the United States and worked his way through college, New York University, earning a BS in aerospace engineering before entering the insurance industry in a trainee role at American International Group (AIG).

47.Andrew Liveris – $107 MILLION

Andrew Liveris, is president, chairman and CEO of international chemical, materials, agroscience and plastics global giant, the Dow Chemical Company, based in Midland, MI. The Australian-born Liveris succeeded Dr. William Stavropoulos, a friend and mentor (also listed in this edition) in 2004 and became Chairman of the Board in 2006. Liveris met with former Greek Prime Minister Antonis Samaras June, 2014, announcing an agreement between Dow and IBM wherein Dow plans to use IBM’s service center in Athens as a base from which to offer data and business analytics support to its multinational clients. In June 2011, President Obama named him co-Chair of an Advanced Manufacturing Partnership, which aims to pool the efforts of industry, schools and the government for innovation in fields like information technology, biotechnology, and nanotechnology. With roots in Kastellorizo, Greece, Liveris was born in Darwin, Australia. As he told students in a lecture in 2005, his grandfather was a Greek sailor who made the impromptu decision to stay in Darwin, after traveling there on a merchant ship at the start of the 20th century. In December, 2016, then-President-elect Trump announced that Liveris would head the American Manufacturing Council in his Administration, part of his economic message to “buy American and hire American.” The Council is the principal private sector advisory committee to the Secretary of Commerce on the manufacturing in the United States. Trump described Liveris as “one of the most respected businessmen in the world,” who will be tasked with finding ways to bring industry back to America. “Nobody can do it like Andrew.”

48.George Tsunis – $107 MILLION

George J. Tsunis uses the quality of human connection in his successful Chartwell Hotels enterprise, which he founded in 2006, building on a family tradition of hotel and restaurant ownership. Chartwell, under Tsunis’ leadership, practices the “live well” philosophy, which focuses on healthy eating and going green at its hotels. The company currently owns and manages ten hotels, including Chartwell’s Holiday Inn at Williamsport, PA earned a “Newcomer of the Year award” from Holiday Inn in 2007. Tsunis contributed nearly $1 million to President Obama’s 2012 reelection campaign. In September 2013, Obama nominated him for ambassador to Norway. After a highly publicized series of challenging confirmation hearings before the Senate last year, however, Tsunis withdrew his nomination in December 2014.

49.Tommy Lee – $70 MILLION

Thomas Lee Bass born in Athens in 1962 to American Oliver Bass and Vassiliki Papadimitriou, a 1957 contestant in the Miss Greece beauty pageant, he is best known throughout the hard rock/heavy metal world as Tommy Lee, drummer and founding member of the rock band Motley Crue. He received his first drum when he was four years old, and grew up listening to classic hard rock bands such as Led Zeppelin, the Sweet, Van Halen, and Cheap Trick. Drummers John Bonham of Led Zeppelin and Alex Van Halen of Van Halen are two of his biggest influences. From 2014 to 2015, Lee rejoined Motley Crue for a special “Final Four” tour, during which they would give their adoring fans what they want most – seeing the original members live one last time – and then promised to have legal papers drawn to formally end their joint touring in the future.

50.Tina Fey – $65 MILLION

With a celebrity star continuing to rise with no peak yet in sight, Elizabeth Stamatina Fey, known to the world as Tina, added to her net worth in 2016 to finish in our top 50.